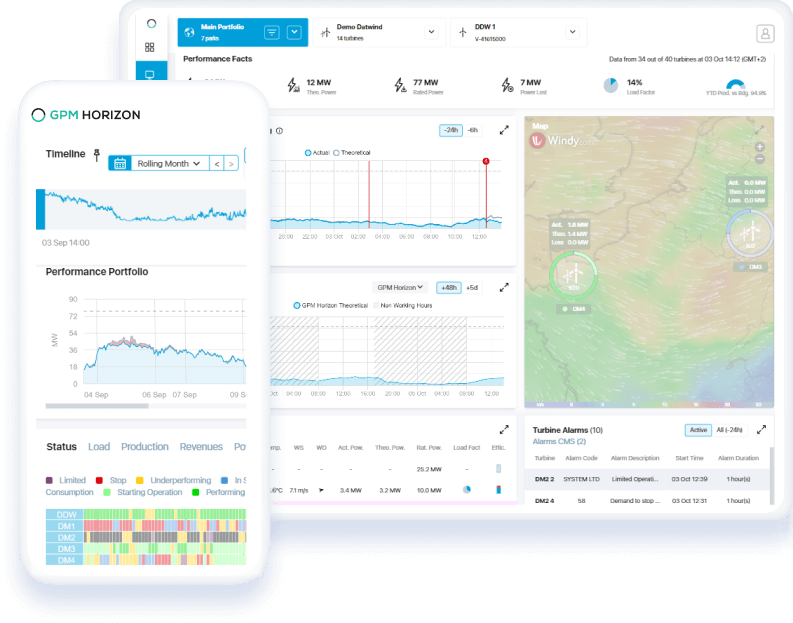

Leading the green energy transition with datA-driven digital solutions

Best-in-class solutions to manage, monitor and control renewable assets.

User-focused asset management solutions that enable the optimization of preventive and corrective actions.

ASSET MANAGERS,

OPERATION AND MAINTENANCE

Well-planned and executed operations

ASSET OWNERS

Long-term investment and performance maximization

ENGINEERING, PROCUREMENT AND CONSTRUCTION

High-performing commercial projects

How do you choose the ideal Horizon modules to optimize energy production?

Subscribe exclusively to the modules aligned with your asset management objectives. GPM Horizon seamlessly integrates with second-level SCADA and DAS systems.

We are experts in managing utility-scale renewable energy power plants.

7500+

FACILITIES

90+

COUNTRIES

73+

GIGAWATTS

Our customers

We solve energy management problems.

You get results.

Accelerating efficiency in solar, wind, storage facilities around the globe.

Sign up to our newsletter!

Stay informed with exclusive updates, events, industry insights, and more.

Latest global news, events, and resources

-

GreenPowerMonitor will attend Intersolar Middle East and World Future Energy Summit, both will be held from April 16 to 18 in Dubai and Abu Dhabi respectively. Do…

Energy | Energy Transition | Intersolar | Renewable energy | Renewable energy asset management | Renewables | solar | wind | World Future Eenrgy

-

GreenPowerMonitor will attend Solar+Storage Mexico 2024, to be held on 17 – 19 April in Guadalajara, Mexico. Solar+Storage Mexico is an exhibition specialized in the energy storage and solar…

Energy | Energy Transition | Renewable energy | Renewable energy asset management | solar | Solar energy | Storage | Storage energy